Extends the WTO’s earlier condemnation of massive illegal subsidies to Boeing to 26 billion USD in the form of wholly non-refundable corporate welfare. This is the single largest state-level instance of corporate welfare in US history.

The subsidy package condemned by today’s report is large enough to fund the entire development of the 777X and has already cost Airbus $50 billion in sales.

This is only the second time in the WTO’s 20+ year history that a country has been found to have provided prohibited subsidies contingent on domestic content.

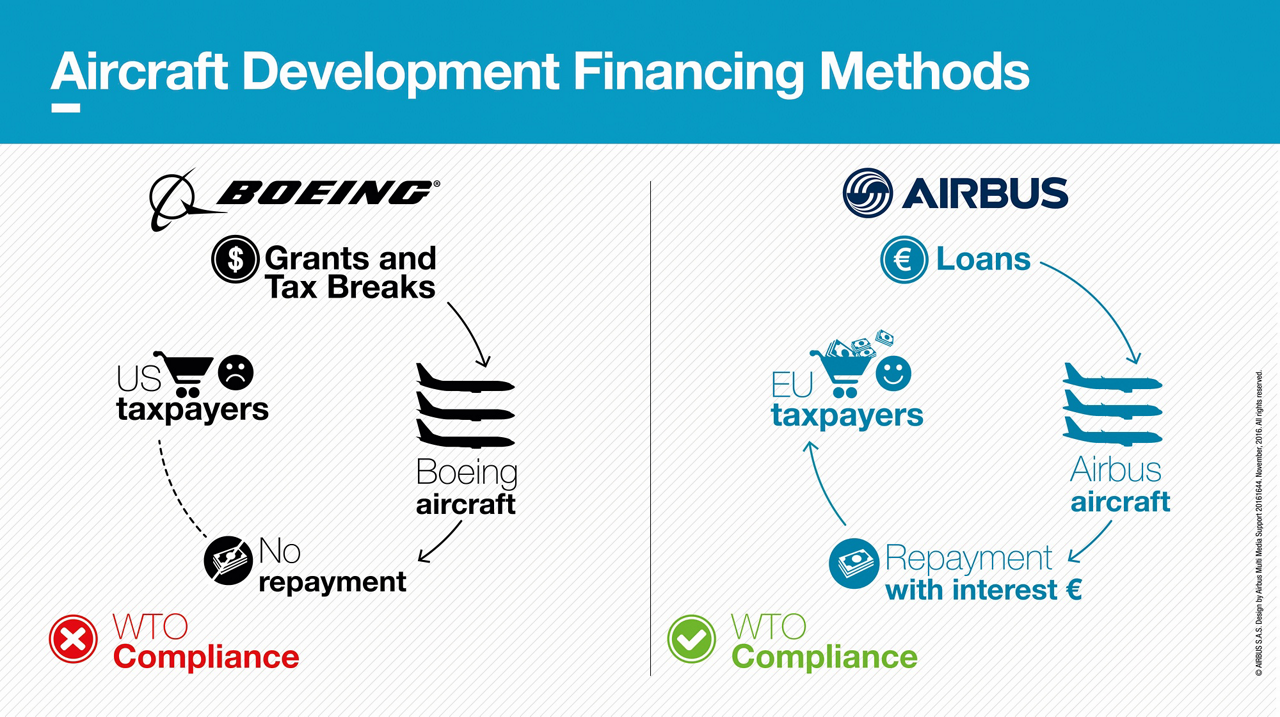

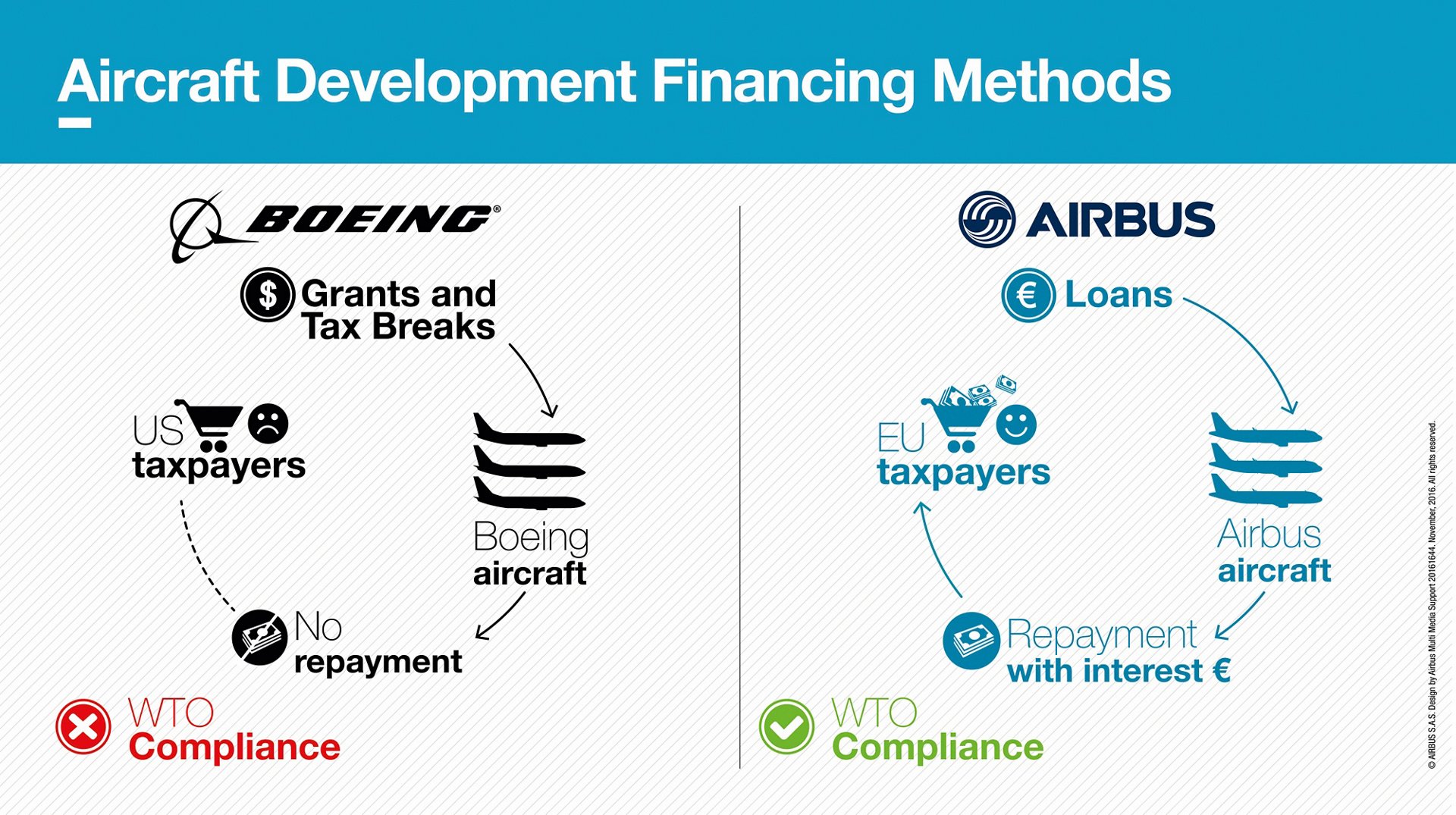

Industry specialists suggest that the nearly $9 billion in subsidies provided by Washington State is largely sufficient to cover the entire cost of design and production of the 777X, essentially giving Boeing a “free ride” by offsetting entirely the costs of developing and bringing the aircraft to market.Considering today’s ruling, together with the 2012 ruling in the original dispute, Boeing has caused at least $95 billion in commercial harm to Airbus, opening the door to trade sanctions against the US in an equivalent amount. As Harrison explains: “The WTO has for the first time in these disputes identified prohibited subsidies to Boeing for the 777X, condemning as the worst form of trade violation a full aircraft development illegally financed by taxpayer money. And that is supposed to be good for American business and workers? Unlike the loans to Airbus – the interest rates of which were considered in the WTO dispute against the European Union – Boeing plans no repayment of any kind.” Harrison added that: “The United States has no other option than to direct that Washington State repeal the legislation or amend it in a way that makes it WTO-compliant. That would obviously take away any incentive to keep producing the 777X in Washington State and it will certainly not benefit Boeing’s balance sheet.” The Panel has declared that the US must end the prohibited subsidy regime in Washington State within 90 days. This is on top of the ongoing US failure to comply with the original WTO ruling against Boeing subsidies - for which the public panel report is expected in the next several months.Airbus once again congratulates the European Commission and the Governments of France, Germany, the UK and Spain for their success at the WTO, and is grateful for the years of effort they have invested in setting the record straight. “We hope this outcome will lead those at Boeing who advocate continuing this trade dispute to reconsider,” Tom Enders concluded.

More on WTO

Relevant references to the report :

Quotes From the DS487 Panel Report

Para. #

Quote

Purpose Behind Washington State Aerospace Tax Measures

7.63

“The mechanism for achieving the objective of encouraging the aerospace industry [in Washington State] is, in the words of both pieces of [its] legislation, the provision of tax ‘preferences’, ‘exemptions’, and ‘incentives’”.

Financial Contribution & Subsidy Findings

7.157

“Accordingly, the Panel finds that each aerospace tax measure constitutes a financial contribution [to Boeing] within the meaning of Article 1.1(a)(1)(ii) of the SCM Agreement because ‘government revenue that is otherwise due is foregone or not collected’”.

7.162

“For tax-based financial contributions such as the aerospace tax measures, the relief from taxation otherwise due is not generally available to market participants, nor does it exist as a general condition in the marketplace. ... Indeed, the ‘market conditions’ that are relevant as the benchmark in this context are the competitive conditions that exist in the absence of the challenged financial contribution. Judging the conferral of a benefit by reference to such market conditions, it is clear that the financial contributions of foregone government revenue otherwise due from certain Washington State taxpayers – through a reduced tax rate, credits against business taxation, or exemptions from otherwise applicable tax liability – makes the recipients ‘better off’ than they otherwise would have been, in the marketplace, absent those contributions”. (emphasis added)

7.165

“Having concluded that there is a financial contribution by the Washington State government under each of the aerospace tax measures at issue, and that a benefit is thereby conferred, the Panel finds that each of the aerospace tax measures at issue constitutes a subsidy within the meaning of Article 1 of the SCM Agreement”.

Prohibited Subsidy Finding

7.363

“[T]he use of imported wings would lead to the loss of the [subsidized] B&O aerospace tax rate. In contrast, if the manufacturer were to use wings made in Washington State by another producer, this would not activate the Second Siting Provision [and therefore would not impact the subsidized tax rate]”.

7.364

“In particular, the only decision by Boeing to source wings which it would then ‘use’ in producing the 777X that would not trigger the Second Siting Provision [and the loss of the subsidy] would be to source such wings within Washington State, which by definition would be domestic wings”. (emphasis original)

7.367

“The loss of the B&O aerospace tax rate for the manufacturing or sale of commercial airplanes under the 777X programme if Boeing used 777X wings produced outside of Washington State, even if it maintained production of such wings in Washington State, makes the B&O aerospace tax rate for that programme contingent upon the use of wings made in Washington State”.

7.367

“Accordingly, pursuant to ESSB 5952, and as a result of the Second Siting Provision, the B&O aerospace tax rate subsidy for the manufacturing or sale of commercial airplanes under the 777X programme is contingent de facto not only on the production of that aircraft and its wings in Washington State, but additionally on not using 777X wings other than those made in Washington State. Since wings made in Washington State are domestic goods and any imported wings would by definition be made outside of Washington State, it follows that the Second Siting Provision makes the B&O aerospace tax rate for the manufacturing or sale of commercial airplanes under the 777X programme contingent upon the use of domestic wings over imported wings”. [MC1]

Conclusions and Recommendations

8.1(a)

“Each of the seven aerospace tax measures at issue in the present case constitutes a subsidy within the meaning of Article 1 of the SCM Agreement”.

8.1(c)

“With respect to the First Siting Provision and the Second Siting Provision in ESSB 5952, considered jointly, the B&O aerospace tax rate for the manufacturing or sale of commercial airplanes under the 777X programme is a subsidy de facto contingent upon the use of domestic over imported goods within the meaning of Article 3.1(b) of the SCM Agreement”.

8.5

“The Panel has found that the European Union has demonstrated that the B&O aerospace tax rate for the manufacturing or sale of commercial airplanes under the 777X programme, pursuant to ESSB 5952, is a subsidy contingent upon the use of domestic over imported goods, prohibited under Articles 3.1(b) and 3.2 of the SCM Agreement”.

8.6

“Accordingly, taking into account the nature of the prohibited subsidy found in this dispute, the Panel recommends that the United States withdraw it without delay and within 90 days”.